Dividends for the people

Peter Barnes, author of Capitalism 3.0, writes for onthecommons.org:

Why don’t we pay everyone some non-labor income — you know, the kind of money that flows disproportionally to the rich? I’m not talking about redistribution here, I’m talking about paying dividends to equity owners in good old capitalist fashion. Except that the equity owners in question aren’t owners of private wealth, they’re owners of common wealth. Which is to say, all of us.

One state—Alaska—already does this. The Alaska Permanent Fund uses revenue from state oil leases to invest in stocks, bonds and similar assets, and from those investments pays equal dividends to every resident. Since 1980, these dividends have ranged from $1,000 to $2,000 per year per person, including children (meaning that they’ve reached up to $8,000 per year for households of four). It’s therefore no accident that, compared to other states, Alaska has the third highest median income and the second highest income equality.

Alaska’s model can be extended to any state or nation, whether or not they have oil. Imagine an American Permanent Fund that pays dividends to all Americans, one person, one share. A major source of revenue could be clean air, nature’s gift to us all. Polluters have been freely dumping ever-increasing amounts of gunk into our air, contributing to ill-health, acid rain and climate change. But what if we required polluters to bid for and pay for permits to pollute our air, and decreased the number of permits every year? Pollution would decrease, and as it did, pollution prices would rise. Less pollution would yield more revenue. Over time, trillions of dollars would be available for dividends.

Read his piece here.

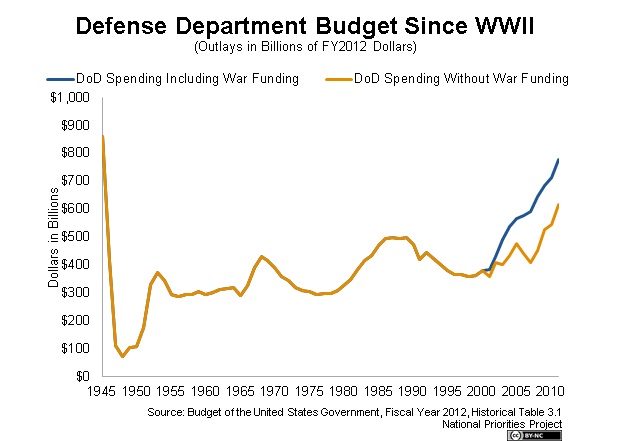

U.S. Defense Department budget since WW2

Food for thought from the National Priorities Project:

As the chart below shows, current defense spending levels – even without funding for the wars in Iraq and Afghanistan – are higher than at any time since World War II when adjusted for inflation.

We’re Not Broke

Watch the trailer for the new film, We’re Not Broke

“…the story of U.S. corporations dodging billions of dollars in income tax, and how seven fed-up Americans take their frustration to the streets…and vow to make the corporations pay their fair share.” – from werenotbrokemovie.com

Robert F. Kennedy versus GDP

Hear Robert F. Kennedy’s words, just as compelling today as when they were spoken shortly before his assassination in 1968:

Source: http://www.youtube.com/watch?v=77IdKFqXbUY

Unequal and unstable

The correlation between income inequality and financial crises raises an important question: could it be that extended periods of increased income inequality help to cause financial crises? Evidence suggests this may well be the case, through three primary mechanisms that reinforce each other:

- Sharp increases in debt-to-income ratios among lower- and middle-income households looking to maintain consumption levels as they fall behind in terms of income;

- The creation of large pools of idle wealth, which increase the demand for investment assets, fuel financial innovation, and increase the size of the financial sector;

- And disproportionate political power for elite financial interests which often yields policies that negatively affect the stability of the financial system.

Read their analysis here.

Economic fallacies: time to work more, or less?

In the models of neo-classical economics times like the present are assumed away. But when we’re actually living through them, we need to recognise that measures that result in higher hours can be counter-productive by creating more unemployment and investor pessimism. Similarly, responding to shortfalls in pension programs by asking people to stay in the labour force more years further dis-equilibrates the market by creating more demand for a limited number of jobs.

Tent City University

The U.K.’s “Tent City University” offers a short course in occupied economics:

http://tentcityuniversity.occupylsx.org/?page_id=172

Fracking democracy

In 2010, Pittsburgh’s City Council voted unanimously to ban hydraulic fracturing for natural gas extraction within city limits. Now the Pennsylvania legislature is moving to deny local governments the right to protect the local environment:

We don’t have a fracking problem. We have a democracy problem.

Read about it here.

Globalization of protest

From Nobel laureate Joseph Stiglitz:

The best government that money can buy is no longer good enough.

Read his piece here.

Video: America Beyond Capitalism

“If it can happen in Cleveland, it can happen anywhere.” Gar Alperovitz on an alternative to state socialism and corporate capitalism:

Source: The Real News Network.